Farmers in Niger are organizing to get loans, like Oumarou Karbassi, whose group received an animal fattening loan.

Théodore Kabore, Mercy Corps

Farmers in Niger are organizing to get loans, like Oumarou Karbassi, whose group received an animal fattening loan.

Théodore Kabore, Mercy Corps

Farmers in Niger are organizing to get loans, like Oumarou Karbassi, whose group received an animal fattening loan.

Théodore Kabore, Mercy Corps

Farmers in Niger are organizing to get loans, like Oumarou Karbassi, whose group received an animal fattening loan.

Théodore Kabore, Mercy Corps

Speeches Shim

Ibrahim Alassane, 28, his wife Maïmouna and their 2-year-old son Salamane live in the village of Samtigué in the Ouallam department of southwestern Niger. Here, it is dry 10 months out of the year, and the temperatures reach well above 100 degrees Fahrenheit.

Like the majority of Niger’s population, Alassane and his family raise small livestock and grow millet, cowpea and other rain-fed crops to meet their household needs. But worsening and more frequent droughts across the Sahel mean that managing through each lean season—the four months, on average, between growing seasons when food is scarce—is becoming harder, and shocks like brush fires, livestock disease epidemics and locust invasions have more severe consequences on household food security.

The Alassanes are one of 225 vulnerable families who are coming to appreciate the benefits of tailored financial services as an effective way to manage their household resources, particularly through seasonal challenges.

Mercy Corps and Nigerien microfinance institution ASUSU S.A. piloted the warrantage model following last year’s cereal harvest and leading up to the 2015 lean season. Typically, farmers, particularly the most vulnerable, must sell their produce immediately after harvest, when everyone else is selling and prices are lowest, because they need the money right away. Under the warrantage system, rather than selling their harvest immediately, farmers can use it as collateral to obtain credit from a microfinance institution (MFI). By bundling their produce together and organizing under a group credit, farmers attract investment from an MFI and get a better interest rate, and they can share warehouse space.

Credit, which is granted to farmers based on the amount of produce they store, is used to invest in other income-generating activities or to purchase essential household items, such as medicines. The farmers store their produce in a locked warehouse with keys held by both the MFI and the farmers group, and they can sell it later in the year when prices are much higher—also ensuring repayment of the credit.

Though common in other regions in Niger, warrantage is being introduced for the first time in the Ouallam department through the USAID-funded Espoir pour les Communautés de Ouallam, Tillabéri (ECOUT) program, or Hope for Communities in Ouallam, Tillabéri region.

ECOUT works to improve food security among the most vulnerable households in two communes in the Ouallam department and increase agro-pastoralists’ capacity to respond to recurring drought.

“This warrantage activity, I had never heard of it—the first time was with Mercy Corps,” says Alassane. “This activity is really useful and has brought solutions to my problems, particularly at the start of the lean season.”

In five villages where ECOUT is being implemented, 386 men and women agreed to try the warrantage credit and organized into farmers groups, identified community warehouses that met storage requirements to receive credit, and pooled portions of their freshly harvested cereals. Across the villages, they stored 17.4 metric tons of cereals, each person contributing as much as he or she wished—in most cases, a cautious one to two bags of non-perishable produce. The produce was verified by ASUSU and stored in the community warehouses, which were locked with two padlocks: one key was held by the farmers’ group and the other by ASUSU.

Individual farmers received 80 percent of the value of their produce in the form of microcredit. Over $6,300 in loans was approved and dispersed, and the produce—with its appreciating value—served as collateral for repayment. ASUSU offered a modest interest rate of 1.7 percent. All farmers repaid the balance of their loan without default, and when the credit term ended, they regained their bags of produce.

“I stocked two bags of millet of 100 kilograms which enabled me to get a loan of 37,000 [CFA francs, or XOF] from ASUSU,” says Alassane. He used this loan—worth about $64—to purchase two sheep for fattening. He dewormed them and fed them regularly over the next two months, and resold them on the market for 70,000 XOF ($121), for a profit nearly equivalent to the initial loan he received.

Alassane used part of the income generated to repay the loan, and when the warrantage term ended and the warehouse was opened four months later—timed to coincide with the height of the lean season—he used one bag of his stored millet to plant his fields and the second as food for his family.

After repaying the loan, Alassane was able to use the profit to meet other household needs. “I used this profit from sheep fattening for small household needs—condiments, meat, macaroni—as well as for the children’s small needs,” he said. “I bought baby formula at the pharmacy in Ouallam as a complement because my wife’s milk isn’t sufficient anymore for our child.”

More than half of the participants used their credit for income-generating activities—such as selling condiments, cola or tea, or livestock fattening—which generated individual profits between $3 and $40. Others used the money to cover immediate household needs. The reimbursement rate for loans to ASUSU among all participants was 100 percent.

Risks and Rewards

Risks with this type of credit model, while relatively low, do exist. Before approving credits , ASUSU inspected the warehouse in each village to ensure it passed basic security measures and was outfitted with appropriate storage materials, such as wood pallets to minimize the risk of damage to the products. ASUSU and each village group agreed to a schedule of regular monitoring visits over the course of the loan period to verify that the produce remained in good condition, as well as to monitor market prices.

Alassane says he regrets not having stocked more—he was prudent the first time, but plans to put up 10 bags of millet and cowpea during this year’s season.

“Before, we couldn’t have credit, you’d make yourself tired without success. Within the community, people don’t trust the poor, and I didn’t know about ASUSU—it’s my first time,” he said. “Warrantage can help us fight the war against poverty.”

Access to traditional banking services in Niger remains a major challenge: Only 1 percent of the population has access to finance from a formal institution, with 43 percent relying on family and friends for short-term loans. The high-risk nature of areas like Ouallam, where high poverty levels make investment more risky, can pose barriers to financial institutions, and too few or only negative experiences with such businesses can make credit and savings products seem suspicious to potential clients.

While loans made through warrantage may be small, permitting households to make small investments in agricultural inputs and other livelihood activities can be an entry point to additional financial products in traditionally underserved communities.

“This pilot phase went very well. What is certain is that we will ensure better service in terms of monitoring and coverage,” said Soufiani Maharou, the interim head of ASUSU’s Ouallam office. “It must be recognized that we are not present in the [neighboring] Dingazi region because of its inaccessibility during the rainy season, but this partnership led us to cover all of the ECOUT program intervention villages and even to establish ourselves outside of villages where Mercy Corps works.”

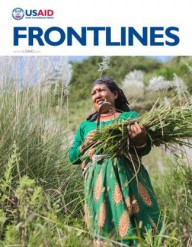

Since the pilot ended in May, more than 48 people have opted for other types of small agricultural and livelihood-based credits, including Oumarou Karbassi, 48, from Kouffey village. He and others from Kouffey took a group loan for animal fattening.

“Personally, me and the village of Kouffey appreciate the MFI [microfinance institution] for the reason that our group put together a loan request for fattening. The 22 members each received a sum of 60,000 FCFA [CFA francs], which we will reimburse in six months. With the amount received, I bought a ram at 57,500 FCFA which, after five months of fattening, I plan to sell at about 90,000 FCFA,” says Karbassi—a potential profit of about $56.

The positive experience of participants across the five pilot villages is having a spillover effect: Neighboring villages have taken note and are planning to organize and apply for a warrantage credit for this coming winter season.

Mercy Corps’ Danielle Jolicoeur is regional resilience adviser for West, Central and North Africa, and Théodore Kabore is program manager for food security and resilience.

Comment

Make a general inquiry or suggest an improvement.